Customer feedback is accessible more than ever through multiple channels. Still, many companies don't look at it with the proper attention and lose the opportunity to explore it more strategically. One unique qualitative customer feedback can give you information about your brand, your product, and even about the customer itself. For example, feedback can show how customers interact with your brand and product, what they like or dislike the most, how they use the product, how they see your product compared to the competitors', or even if they are loyal customers that promote your brand.

The power of customer feedback is underestimated, but when it comes to product management, can be a turning point to successful performance. Listening to the voice of customers can support your product strategy in different phases, from ideation to discovery and go-to-market, passing to feature prioritization and roadmap definition.

Customer feedback matters

Looking at customer feedback has become increasingly important over the years, with initiatives mostly led by Brand & Customer Service teams to respond to customer comments to avoid brand damage and increase brand loyalty. A customer's opinion can reveal positive and negative experiences and, in both cases, they are opportunities for product and service improvements, strategy review, or validation.

For example, identifying and acting on negative feedback in record time can avoid damage to your brand image and give you time to revert any customer issue that could make you lose the client. According to marketing firm Moz, just one negative article can lose a company as many as 22 percent of its customers.

Customer feedback can also be an opportunity to understand customer needs better and convert a customer into a brand lover who will promote your brand and product spontaneously. Many times, loyal customers will help the business grow faster than sales or marketing initiatives. About 94% of consumers who had a good customer experience say they would recommend the company and purchase more times.

However, customer opinion is commonly used by marketing and customer experience teams, it can also be strategic for the product area. For the product professional Emily Wang, "it is the job of the product team not only to be responsive to customers but to guide and inform how customers think about the possible solutions to their problems."

Why is customer feedback important for product management?

Gathering and analyzing customer feedback should be part of the culture in companies of any size, from startups to enterprises. There are many reasons to include customer feedback analysis in product strategy, starting with the fact that it can increase upselling and cross-selling success rates by 15% to 20%, according to Gartner research.

By paying attention to the voice of the customer, a company is more likely to better understand customer preferences and needs, develop products aligned with customers' expectations, and improve satisfaction levels. A Bain & Company analysis shows that companies that excel in their customer experience grow revenues 4%"“8% above their market.

But the benefits of incorporating customer feedback into a company's routine can go beyond delivering a better brand or service: it can drive strategic product management decisions, helping companies decide which products to build or to let go of, going even further in increasing satisfaction and profitability. When looking at the product management process, it's easy to see the central role of looking at customer needs in it, as product managers need to first identify the problems and needs of consumers and later prioritize which products and features to build based on their impact on users.

Understanding the customer to build something that addresses their needs is a critical part of the Product Management discipline, and customer feedback can be used as a powerful resource for that. Based on what your customers say about your product or the one from a competitor, it's easier to identify bugs or missing functions that can be used for feature prioritization. It is also possible to uncover new jobs-to-be-done or desired functions and explore that later in targeted user interviews which will also generate more insights. All of that will help you solve problems much faster and free time to focus on improving the product and investing in innovation.

Customer feedback lets you understand how customers use and evaluate your products versus competitors' products. It is essential to determine where your products or services excel or fall short compared to alternatives on the market.

Where to collect customer feedback

Although many companies gather customer feedback only through sales channels, there are numerous other sources to collect them. These sources are normally split into two main groups: first, spontaneous comments shared by consumers or passive feedback. Second, feedback is collected when your company asks for the customer's opinion - we call it active feedback.

Active feedback

Is very useful for collecting customer opinions on specific product releases or updates and is often measured over time to assess progress. Despite the efforts coming from your team, the results depend on your audience's proactivity; in this case, it is essential not only to decide how to collect the feedback but also to promote it very well, so work closely with the marketing or customer experience team will make all the difference.

Here are some ways of actively collecting customer feedback:

- Feedback surveys

Customer feedback surveys are a set of 4-5 questions sent to the customer after their interaction with the brand asking about their experience. The surveys can be sent on multiple channels such as email, in-app, WhatsApp, communities, etc. Tools like Qualtrics, Medallia, and Surveymonkey are examples of solutions that sit in this area.

- CSAT

It is short for customer satisfaction score. It's a commonly used metric that acts as a key performance indicator for customer service and product quality in all kinds of businesses. CSAT is measured through customer feedback and it is expressed as a percentage from 0 to 100.

- NPS

Net Promoter Score (NPS) is customer loyalty and satisfaction measurement taken by asking customers how likely they are to recommend your product or service to others on a scale of 0-10. The score is calculated by subtracting the percentage of Detractors (those who rate 0 through 6) from the percentage of Promoters (those who rate 9 or 10).

- In-app feedback & micro surveys

Feedback can be collected without forcing customers to leave the app. They also help collect feedback for specific app features and understand the customer expectations with context. They act as on-screen triggers in which users can interact with touch gestures.

Micro surveys are a type of in-app feedback and, as the name suggests, they are a very small type of survey whose main differentiator is the fact that it's inserted in the user's journey when using a product. They must be specific and take no more than a few seconds to complete. Companies like Hotjar, Maze, and Usertesting are good options here.

- User interviews and focus groups

Interviews and focus groups are common techniques for collecting qualitative data, particularly about people's experiences, opinions, attitudes, and motivations. Interviewing involves asking individuals or small groups questions about a topic. In product management, it can be used to gain a deeper understanding of users' needs, use cases, and behavior, helping add context to other feedback tactics. It's a technique often used in the discovery stage.

6. Win-loss analysis

Win-loss analysis is used to find out the reasons why a prospect bought (or did not) your product. The process of collecting this data is normally led by sales and should be a part of the sales process that is stored in your CRM. This is a critical piece to better understand what prospects of each segment are looking for and understand what is missing (or working) in your product, your sales process, or other areas.

Passive feedback

Happens when the customer gives feedback without being asked to do it, which makes it much more valuable. The most exciting thing about this kind of feedback is that they are already available for most companies, normally in a continuous process where customers keep expressing themselves spontaneously.

But what are examples of this type of customer feedback? They can be public, being a great source to get feedback about your products and the ones from competitors, or private. Here are the most common ones:

- Support tickets

Every user interaction with your support team generates a support ticket - and the conversation has insights about product usage that can be explored. Most Customer Service platforms, like Zendesk, Hubspot, and Intercom already allow teams to tag each ticket with a theme, but don't go deep into the content of the conversation.

- Social Media

A lot of people like to go to social media, such as Twitter, Instagram, Youtube, or Facebook, to share their experiences with a product. Capturing those comments with a social listening tool can help give a clear picture of what customers say about your product and brand. Comments from social media are commonly used by brand and communications teams, but they can be an important piece for Product teams too. It's important to select the ideal social platform for your business that will fit with your feedback strategy. It means choosing platforms where you know that your audience is more active.

- Communities & Discussion Forums

They are online spaces where users exchange knowledge and information with each other, generating identification with peers. free conversations about features, the performance of products, recommendations, and complaints can be easily found, as well as comparisons of products. It can be an interesting source of feedback to keep an eye on to get a perception of competition. Quora and Reddit are probably the most famous examples here, but there are also branded communities with millions of users interacting every day.

- Product analytics data

Even though product analytics is not an exact type of feedback, is a great source of insights about users, especially if combined with the qualitative customer feedback data previously mentioned. As it tracks the activities of the user while using your product, it gives you the chance to understand their behavior. Precious data can be generated in the product analytics process, teaching you about the customer journey and the high and low touchpoints in the workflow. The weakness of this data is the lack of understanding of context, sentiment, and expectations from the customer - and that's where qualitative feedback enters.

How to explore customer feedback to enrich your product strategy

Now that you know why customer feedback is important and where to get it, the next step is to learn how to work with this information in a strategic way when it comes to your product management process.

It is quite common to see companies collect user feedback as a tactical initiative that will help them generate and report numbers (like NPS scores), but later let these comments be forgotten in some tool or spreadsheet. Other companies go further to take action on the feedback and respond to the user, mainly to take care of their reputation or brand.

Truth is that the bottleneck in managing customer feedback goes way beyond collecting it: it's important to find a way to connect this feedback with your product strategy, avoiding the risk of creating features because an important client asked or avoiding churn from a customer segment. Sometimes vision customer requests don't fit in the product vision, or they ask for things that are not exactly what they need; they might even not know what they need if they never experienced it before. So to identify the kind of feedback that matters to your product roadmap management, it's important to align the data collected from customer feedback to your product strategy, establishing a way to quantify and weight different feedbacks in order to add them to your prioritization process.

And that's where it gets a bit more complex: combining and analyzing customer feedback from multiple sources can be a time-consuming task. Many product teams spend countless hours manually reading and categorizing conversations in their support platforms, or exporting them into spreadsheets or airtable to be able to categorize them with more granularity, and they end up not having an easy way to quantify and rank all that data see the big picture, especially if they try to combine data from a variety of sources.

As a company grows, this task becomes even harder and some companies assign these tasks to Product Operations, CX, or UX Research teams, which puts them farther from the customer but saves them time, especially since the trend in these cases is for the volume of feedback to increase. Critical insights can get "lost in translation" (with data being filtered by CX, Research, or any other area) if you don't put a system in place to categorize and organize all the data you collect that is easy to access, configure, and use by different teams.

It's our belief that there are three critical steps for an optimal process of exploring customer feedback to support your product strategy: centralize, classify, and analyze.

Let's quickly look into them:

- Centralize

Centralizing the customer voice from all the different sources of the feedback mentioned before in a single place is the first step of this process. This is important not only to consolidate the data but also to allow Product Teams to manage this data continuously, establishing a feedback river that is essential to improve product strategy and connect it to innovation in a continuous feedback loop. To build a product's continuous feedback loop, Sachin Rekhi, founder and CEO of Notejoy, says there are three distinct parts to be considered:

- Establish a "feedback river" which gives you real-time access to feedback on a regular basis.

- Create a feedback system of record, which gives you a single source of truth for all your aggregated customer feedback.

- Perform deep synthesis of the feedback you've received to really understand what your customer is aspiring to do - which takes us to the next step.

- Classify

Once you have all of your feedback in a single place, a new problem arises: finding the time to correctly look into that data in order to organize, group, and make sense of it. In a recent round of interviews with 100+ Product Managers here at Birdie, we identified that for 51% of them the most significant pain when it comes to customer feedback is categorizing and quantifying qualitative feedback to be able to extract insights out of it.

And this is true for most companies: in smaller teams, the challenge is finding the time to go through so much data in such little time. In bigger teams there can be more people looking into it, but then the problem becomes managing your taxonomy of tags. In both cases, is difficult to create and mantain a pattern to combine different pieces of feedback and different verbatim as part of the same group when you have more than one person looking into it, and as your customer feedback volume grows, the effort - and the chaos - increase in the same proportion.

Without this step, therefore, it's almost impossible to really understand the pulse of the customer, because there is still a chance you're looking into feedback with the bias of making decisions based in just a few comments or a specific customer segment.

- Analyze

With your feedback centralized and organized, it's time to run analyses. If everything went well in the previous phases, chances are that this part is easier to execute as all the data will be organized and you will have access to a shortlist of criticall issues, expectations, priorities, jobs to be done, and more. The best of all: they will be all backed by a powerful combination of qualitative and quantitative data: real customer comments with percentages and incidences for each one of them.

Having all these organized data in a single place also make it easier to share the knowledge with other teams, letting them build ther own cohorts, make their own analyses, and dive deeper into the data in any way them want, making sure that you're creating a truly customer-centric and product-centric culture in your organization.

Taking action on customer feedback

Once your company establishes a process that goes beyond feedback collection, building a process with these three steps, it gets much easier to take confident actions that are aligned to your product strategy: you have a list of requirements, you know how many and which profiles of users are mostly interested in it, and you have a way to estimate and prove its impact into customer engagement and satisfaction.

It's then time to prioritize and take action on these themes, and that can be done in different ways. It can help you review your product vision and strategy, identify new opportunities and trends, prioritize features to build or bugs to solve, or even make you decide to run very specific discovery interviews based on a topic that emerged from user feedback.

Another benefit of building a Product Strategy and Product Management process centered in customer feedback is that it becomes much easier to put the whole company on the same page, as you're moving from a situation where people are making their decisions based on opinions, heated conversations, or siloed data to a situation where the customer is considered, siloes are broken, and the knowledge is spread within the organization.

The best of it? It's much easier for you to know which customers to reach out to when doing that, closing the feedback loop we mentioned before.

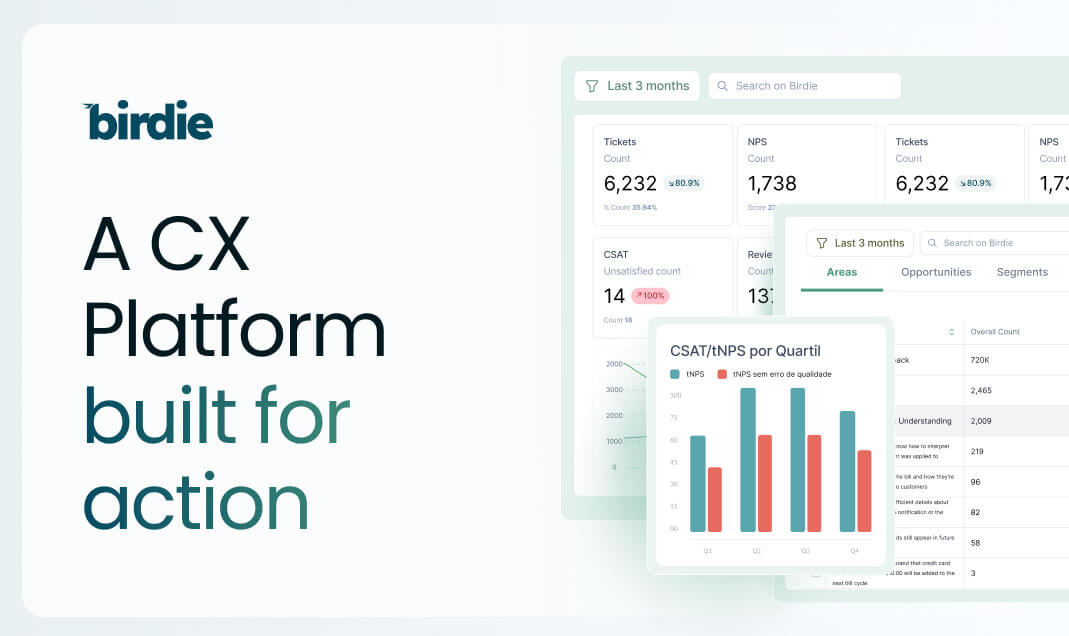

With Birdie, you can improve the way you manage customer feedback to help you get best-in-class data and build a truly product-centric & customer-centric way of managing your products. Our Feedback Analytics Platform gives the foundations of the three critical steps previously presented, allowing you to collect and concentrate user opinions from diverse sources and use AI to quantify this qualitative feedback at scale and generate insights reports that can be shared throughout the organization. If you want to learn more, get in touch.